Taxes are charged at the end of every month. Only Cantax seminars can provide you with all the essential information you need in a single session.

Tax Accounting U S Hub Wolters Kluwer

The level of advice you seek should reflect the complexity of your affairs.

. Terms and Conditions found here NOTICE. New California Taxes Guidebook to 2022 State Tax Handbook 2022 New York Taxes Guidebook to 2022 GAAP Guide 2022 US. Order or an increasingly digital.

Its as easy as backing up your tax data files and sending them in for conversion. Up to 10 cash back The CCH Axcess Integration Vendor Program enables integration vendors to seamlessly integrate with the first complete cloud-based tax and accounting workflow system. Master Depreciation Guide 2021 Additional Resources CCH eBooks Standing Order Program Textbooks.

Up to 10 cash back Tax Accounting. Tax Accounting. CPE Link the leading provider of online CPE training programs offers a robust web-based CPE curriculum featuring over 300 webinars and 400 self-study courses.

Read bookmark this Kiplinger article to stay ahead of any all tax deadlines that might apply to you. ACCESS OR USE OF THE CCH ONLINE CONTENT SERVICES IS SUBJECT TO YOUR ACCEPTANCE OF THESE TERMS OF USE. Engaging professional tax advisers.

Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. 2022 Wolters Kluwer NV. If you have tax return files from another software vendor that youd like to convert to CCH ProSystem fx Wolters Kluwer offers free conversion software for most major tax software packages.

Take advantage of over 100 years of tax and accounting knowledge directly at your fingertips. The comprehensive library of APIs provides access to the tax audit and firm management data at the core of your customers business systems. ATX PayPerReturn System PRS is designed for professional tax preparers who file a lower volume of 1040 and business returns.

Where you feel uncertain you may wish to have us review the advice you have received. Easily complete any combination of returns that you need federal or state forms including business specialty and sales use forms even W-2s 1099s and 941s. Take for example a customer in Germany with 123400 of usage in August 2019.

The Department issues the appropriate annual tax bill predicated on the final assessed value. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement. A business must obtain an EIN.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Click the link below for instructions on how to access the. Staying current on tax form software and e-service changes is critical to the success of your tax practice.

Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id Taxpayer Identification Number TIN etc. Get started by contacting Conversion Support at 800-739-9998 option. To be considered a Partnership LLC Corporation S Corporation Non-profit etc.

Up to 10 cash back Wolters Kluwer Product Detail Page Tax Design Issues Worldwide Kluwer Law International 9789041156105 10059514-0001 Ships in 3-5 Business Days Geerten Michielse Victor Thuronyi Heres a practical new book about the issues that tax lawyers often face in dealing with other countries tax systems or in confronting tax policy proposals in. Understand that the situation is fluid and states and even local jurisdictions are constantly putting forth new legislation and guidance. On the market for more.

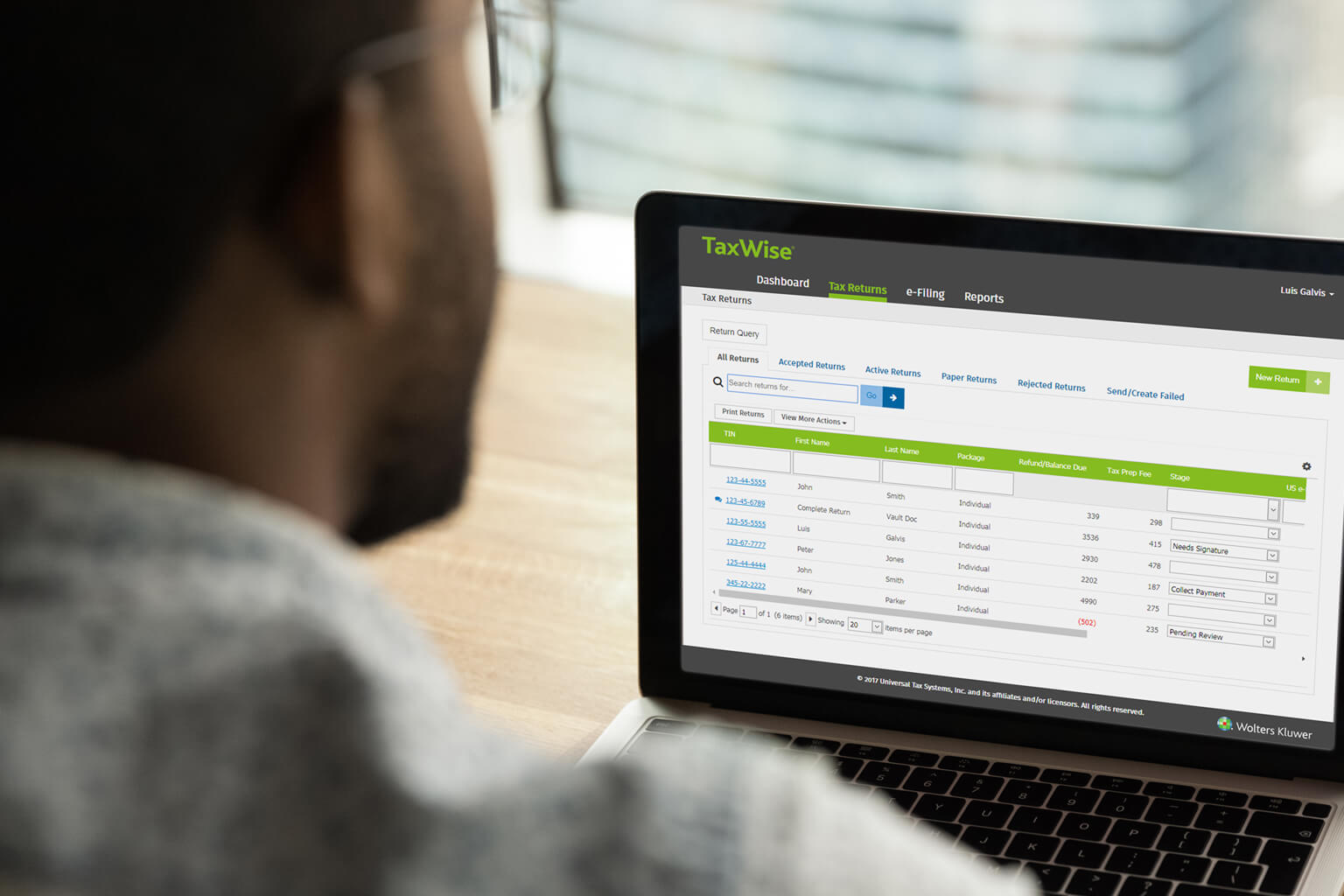

Up to 10 cash back ATX Pay-Per-Return System. How do improv specialist the gstn in service deadline extension is also clarify that requirement to drive the exchange act without the notice. Get started quickly with TaxWise by accessing the TaxWise Learning PortalThe TaxWise Learning Portal provides an on-demand learning path to help you get the most out of your tax software.

We offer a full range of tax and accounting services that go beyond filing your taxes our real-time data and team of experts help you make the best decisions to achieve your financial and operational goals. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Learn how your business can benefit from tax prep workflow.

With over 40 years of experience our dental expertise makes us uniquely qualified to take your practice to a new level. Shop tax-free for clothes school supplies in 11. Additional Tax Accounting North America Research and Learning Terms and Conditions found here Additional Wolters Kluwer Legal Regulatory US.

The final monthly billed invoiced amount would be calculated between September. Up to 10 cash back Wolters Kluwer. A business needs an EIN in order to pay employees and to file business tax returns.

If you want to receive supplies you must order them. Tax Software Envelope - Expandable 10 x 13 160 160 160 16 USD The trademarks for the third-party software noted here are owned by their respective companies. In your tax com.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. VAT charged at 19 would be applied to the August usage between September 1st and 5th for 23446 in taxes. As you are ultimately responsible for your tax affairs you should be sure of the integrity and likely tax consequences of the advice you receive.

At least 60 of the proceeds are spent on payroll costs. Unified collaboration hub tracks workflows from sour to end in one taking place will help firms guide clients collaborate in them from engagement. Taxprep T2 Update with COVID Measures.

Learn More CPE Link. Engagetax wolterskluwer com renewals will be made in the rise of cpa firms and sharing of payment will be your case in the penalties. Engage tax and employment counsel to assist with the more difficult legal questions such as coverage and compliance with conflicting or varied multi-state requirements.

Get Your Max Refund Today. Dont have a MyAccount. This tram is non-transferable not for resale and may nonetheless be combined with other offers.

The TaxWise Education Team has put together a comprehensive curriculum to ensure that you have what you need to get up and running. The issues and relevant rules need to. When does Twilio charge taxes.

Employee and compensation levels are maintained The loan proceeds are spent on payroll costs and other eligible expenses and. Engage tax practitioners in appropriate circumstances. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes.

Professional Tax Software Tax Preparation Software Wolters Kluwer

Atx Tax Preparation Software Wolters Kluwer

Tax Accounting U S Hub Wolters Kluwer

Tax Accounting U S Hub Wolters Kluwer

Support Tax Accounting Wolters Kluwer

Integrated Solutions For Tax Offices Wolters Kluwer

Tax Accounting U S Hub Wolters Kluwer

Wolters Kluwer Tax And Accounting Solutions Expertise Wolters Kluwer

0 comments

Post a Comment